5 Ways to Build Trust Through Branding for Finance Companies

Featured Image: iStock/VectorInspiration

One of the most competitive and regulated industries in the world is finance. Consumers today expect nothing less than the best value, security, and customer service from the companies they do business with. Businesses are more likely to be successful in the ever-growing competitive market if they can gain the customers’ trust with financial branding and live up to these expectations.

This involves a marketing approach to create a distinct, attractive, and unique identity of a company or an organization to promote its products and services specifically designed in consideration of the target audience.

Branding is not just about a flashy finance logo for your brand or a tagline. It is the way a company communicates its identity, values, and personality to its target market. It is hard for a customer to blindly trust a company but financial branding portrays all the positive and appealing aspects of a company or organization which makes the customer more convinced and satisfied.

Image Source: ZillionDesigns/ArtworksKingdom

Image Source: ZillionDesigns/taimoor

Why Brand Finance Companies?

Branding helps in the overall growth and successful marketing of a company or an organization. If you use branding strategies for a finance company there are many benefits you can gain such as boosting your company’s growth and public recognition. Your finance company can use branding for various reasons.

- Trust in Customers: Financial branding helps build trust in customers through the logo design, website, brand voice, and marketing, which is extremely important in any financial service. A finance company having a good reputation and image in the market has had a positive impression and is preferred by customers. For example, they could be known for their excellent credit protection services or their willingness to combat fraud. A critical component of sustaining trustworthiness is ensuring seamless financial operations and data capture processes. Incorporating advanced solutions like digital invoice capture can streamline these operations, therefore reinforcing trust from a backend operational standpoint.

- Competitive marketing: Branding for a finance company can help it stand out among competitors by attracting more customers and making its name and recognition in the market.

- Easy product or service expansion: Good branding helps in building a good reputation for the company. This is useful when the finance company plans to expand its products or services, such as introducing options trading for beginners. The customers then, are ready to accept this additional product or service due to prior trust in the company.

- Reputation: The most important use of branding campaigns for financial companies, particularly those like investment app for beginners, is to improve their reputation. A strong branding approach can help portray the positive aspects of the finance company which in turn helps attract customers and create trust in them.

- Boost company’s growth: Financial branding strategies can help the company to grow exponentially. Once the company starts to get positive feedback and recognition for its branding, more customers are attracted and turned towards the company which can help in the overall growth of the company.

The above reasons tell us about the importance of branding and its overall impact on a company’s growth and customer behavior. The next question arises: how precisely can a finance company apply branding strategies to increase trust? Let’s explore.

5 Strategies for Financial Branding to Earn Consumer Trust

Here are a few key branding strategies for financial services or companies to build trust and create a lasting impact.

1. Define your Core Purpose and Values

Your brand needs to define its brand purpose and values for efficient and effective financial branding of the company. And this begins right from when you launch your website to creating recognition and awareness with marketing. The brand purpose and values form the basis to help in identifying the brand’s individuality and identity.

One of the top corporations in the world for payment technologies, Visa has a distinct brand purpose:

” Enabling individuals, businesses, and economies to flourish by linking the world through the most inventive, dependable, and safeguarded payment network.”

Its brand values are:

“We lead by example. We act as one team. We communicate openly. We deliver with excellence.”

As we can see, they have clearly defined the goals and principles of their brand.

You can define your brand purpose and values by merely responding to these queries:

What is the goal of your company? What principles direct your decisions? What benefits do you offer to society and your clients?

So, for the branding of your finance company, you must have a clear, consistent, and authentic mission statement and driving values. These statements and values should engage with your target audience and reflect the principles and objectives of your business. This ensures effective financial branding and leads to positive growth.

Image Source: brandcolorcode/

2. Create a Distinctive Brand Identity

Your brand should have a unique identity that should make it stand out from other competitive brands. This should be personalized for the financial brand, making it unique in the market. You can come up with a successful brand strategy for financial services consultants by finding the factors that make the business different and better from other brands in the market.

One of the most popular online payment systems in the world, PayPal, has a distinctive brand identity that represents its brand objective.

“To democratize financial services.”

There are two overlapping “P”s in blue and white colors in its logo which is being used to symbolize trust, security, and simplicity.

Its slogan is “PayPal is for everyone who pays or gets paid.”

Using its name, logo, tagline, color scheme, typography, imagery, tone of voice, and other visual and verbal components, PayPal has developed a unique brand identity.

Because of this, a large target audience finds their brand identity distinctive, identifiable, and enticing.

Just like PayPal, you may also focus on financial branding and build recognition among the target audience by developing a unique brand identity. For finance companies, it is essential to create a distinct and unique brand identity for your company so you can achieve the desired results.

Image Source: behance

3. Deliver a Memorable Customer Experience

If the customer is satisfied with your brand, you can use this as a marketing tool to gain the trust of the other potential customers. So, your brand should ensure it keeps its customer experience or user experience for financial clients as one of its top priorities and consistently keeps on improving it.

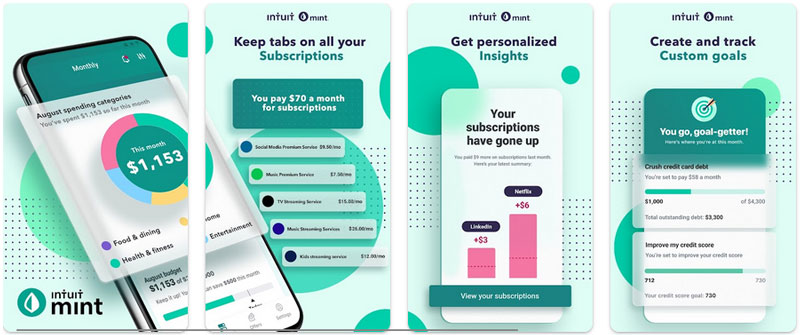

Mint, one of the world’s leading personal finance apps provides customized budgeting, saving, investing, and debt management tips and tools.

Mint stands out from the rest by providing 24-hour customer service through phone, email, chat, and social media.

By delivering a consistent and excellent customer experience they are meeting or exceeding customer expectations at every stage of their journey. This has also led to Mint building trust with its financial branding strategies and earning the loyalty of its clientele.

To deliver a consistent and excellent customer experience you need to first understand the term clearly. A customer’s interactions with your business, including sending detailed invoices using free invoice templates in Excel visiting your website, getting in touch with customer service, using your goods or services, enabling business to send a digital receipt to streamline the operations, receiving invoices or statements, etc. is customer experience. Hence, a company must comprehend the needs, preferences, pain points, and feedback of its clients.

Image Source: behance

4. Showcase Expertise and Credibility

Effective branding is only possible if a company has credible values and expertise to market. So before starting the branding process, you should define your expertise and credibility so you can use this as a powerful tool in branding. It can also be showcased in financial and investment logos to create a positive first impression.

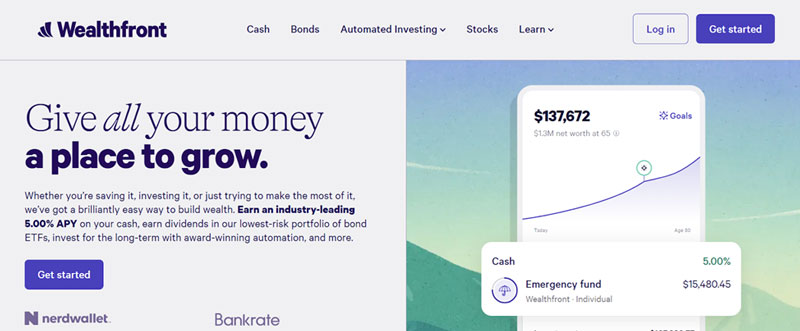

Wealthfront, one of the top robot advisors in the world displays their knowledge and authority by offering informative content on their blog, podcast, and YouTube channel.

Regularly, Wealthfront publishes educational articles on its website to enlighten its customers about tax planning, high-interest cash accounts, asset protection planning, diverse investments, etc.

This consistent posting serves as proof of their knowledge and builds trust among current and potential clients of Wealthfront.

If a business wants to show off its expertise and reputation so that customers may blindly trust it, then engaging the target audience with relevant and fascinating content is crucial. So, for financial branding, one of the first things to do is to highlight the company’s authority and expertise.

Image Source: wealthfront

5. Use Data-Driven Tools for Branding

Utilizing data-driven technologies to strengthen your branding is the fifth step. Technology such as artificial intelligence (AI), machine learning (ML), big data analytics (BDA), etc. can help you optimize your branding strategy and execution.

Examining the behavior, preferences, and responses can help you better understand your target market. You may track and improve your brand strategy for your finance company depending on market demand and competition with tools that allow you to run competitor analysis and offer services that are unique and tailored.

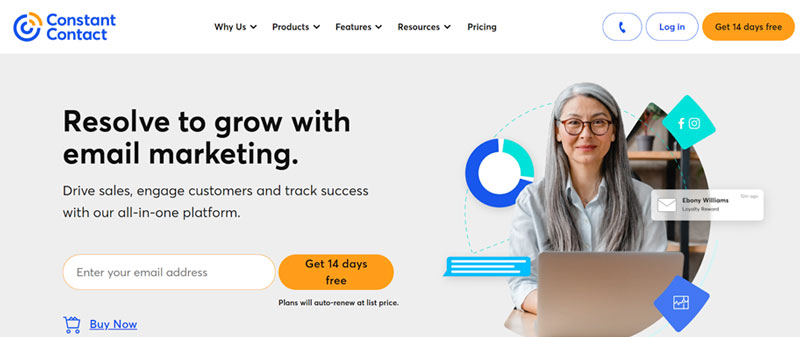

They can help financial companies develop a competitive edge and a long-term advantage in their sector. Data-driven tools like Constant Contact and Nestegg Estimator enhance the financial branding of the company more efficiently as these assets help in better understanding potential customers and their patterns.

Image Source: constantcontact

Wrapping Up

For organizations to survive in the very competitive and regulated market, trust-building through financial branding is crucial. It is the key element in branding your finance company as customers are very careful while investing their money in financial services. If customers consider a finance company trustworthy and credible, they will be likely to invest their time and money in that company and prefer the same company in the future.

You can build a powerful brand that effectively conveys your identity, beliefs, expertise, and trustworthiness to your target market by following these five stages described above. Before anything else, create your logo as that is integral to all of the strategies and their success.